Case Study: WeLab Bank

A Consulting Workshop Case Analysis Presentation

Case: Democratizing Finance with WeAdvisor for WeLab Bank (Hong Kong)

Overview

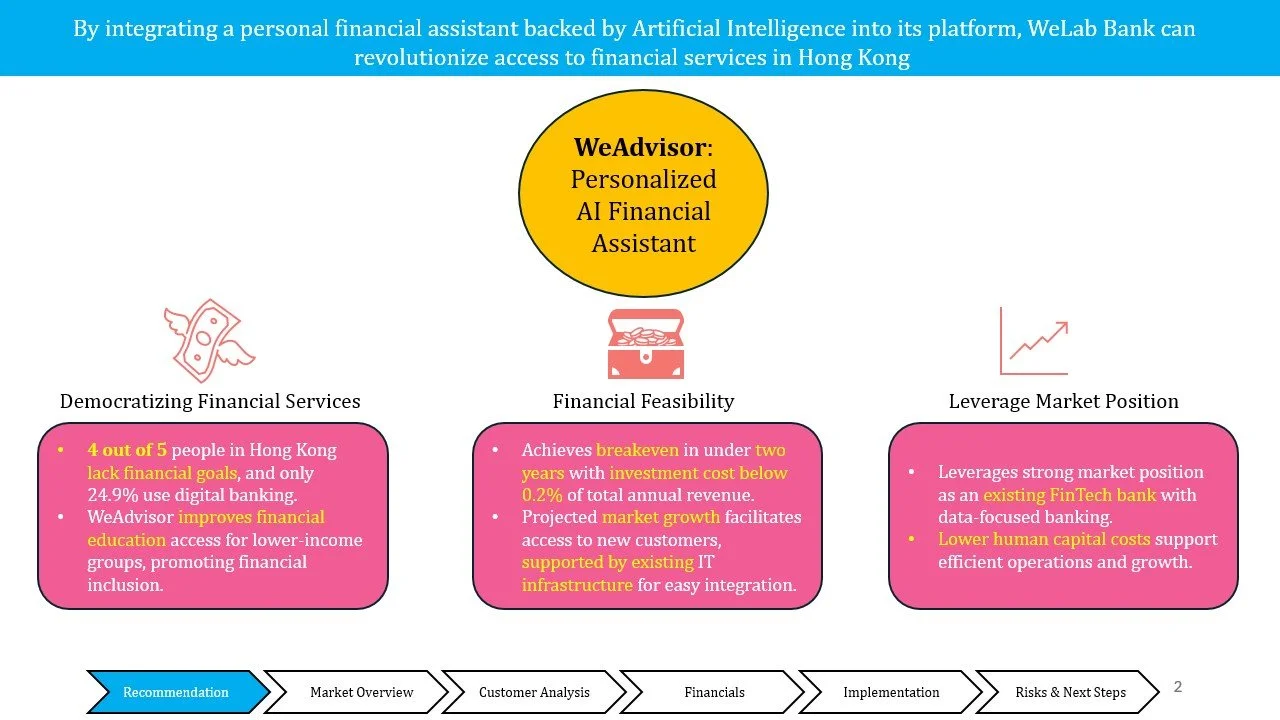

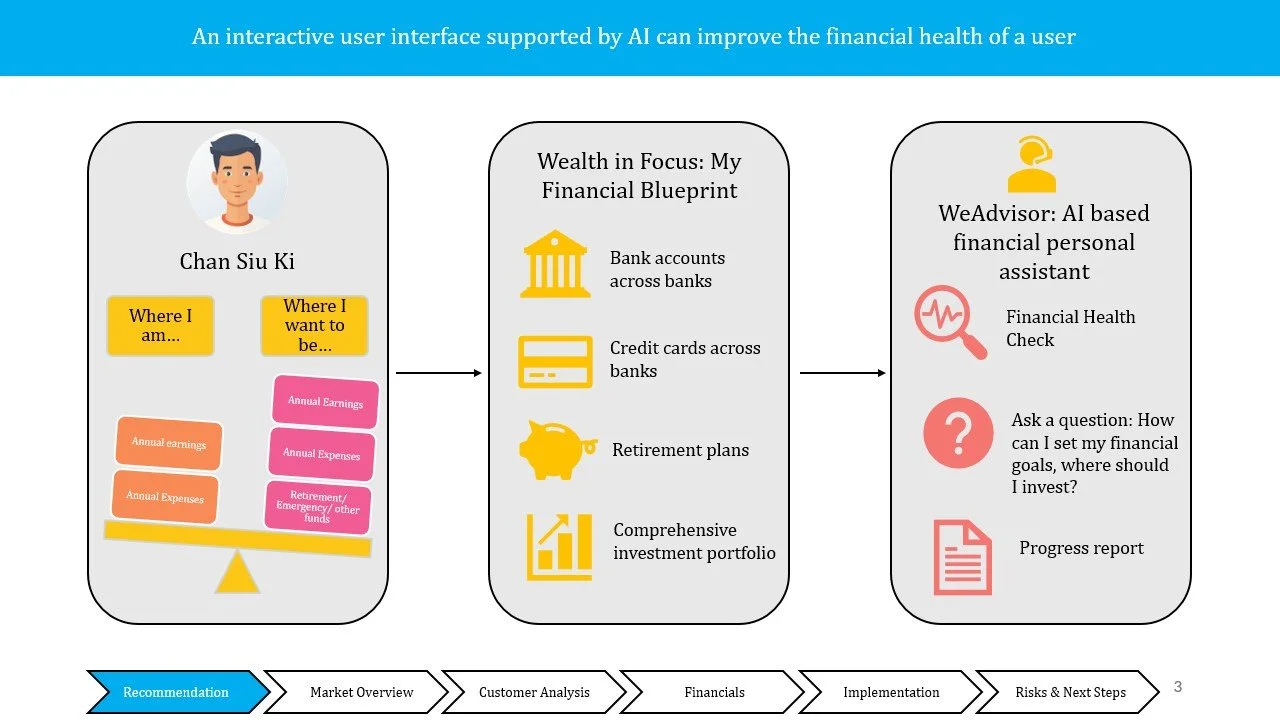

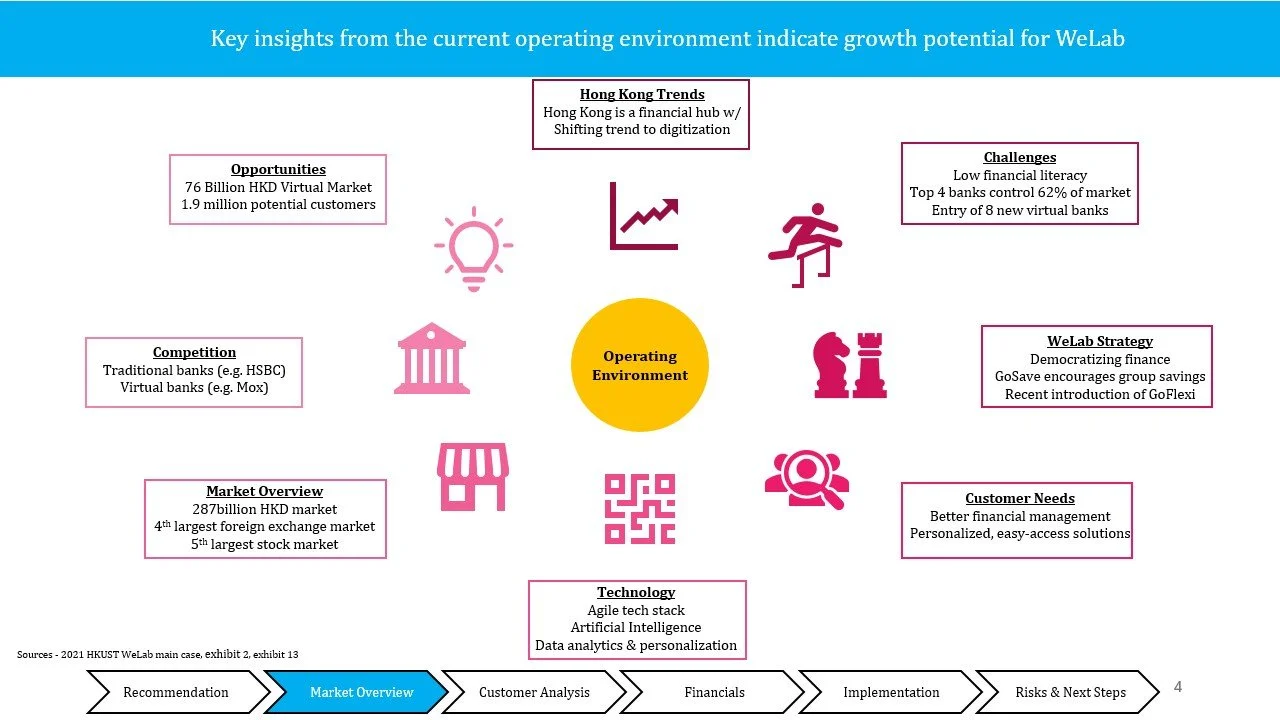

We partnered with WeLab Bank, a virtual bank in Hong Kong, to explore how it could deepen customer engagement and expand access to financial services in a crowded, low-literacy market. Our team recommended WeAdvisor, an AI-powered personal financial assistant integrated into WeLab’s existing digital platform. The solution aimed to improve financial literacy, help customers set and track financial goals, and unlock profitable growth in a HK$76B virtual banking market with 1.9M potential customers.

My Role

Conducted market and customer analysis on Hong Kong’s virtual banking landscape, financial literacy gaps, and digital adoption trends.

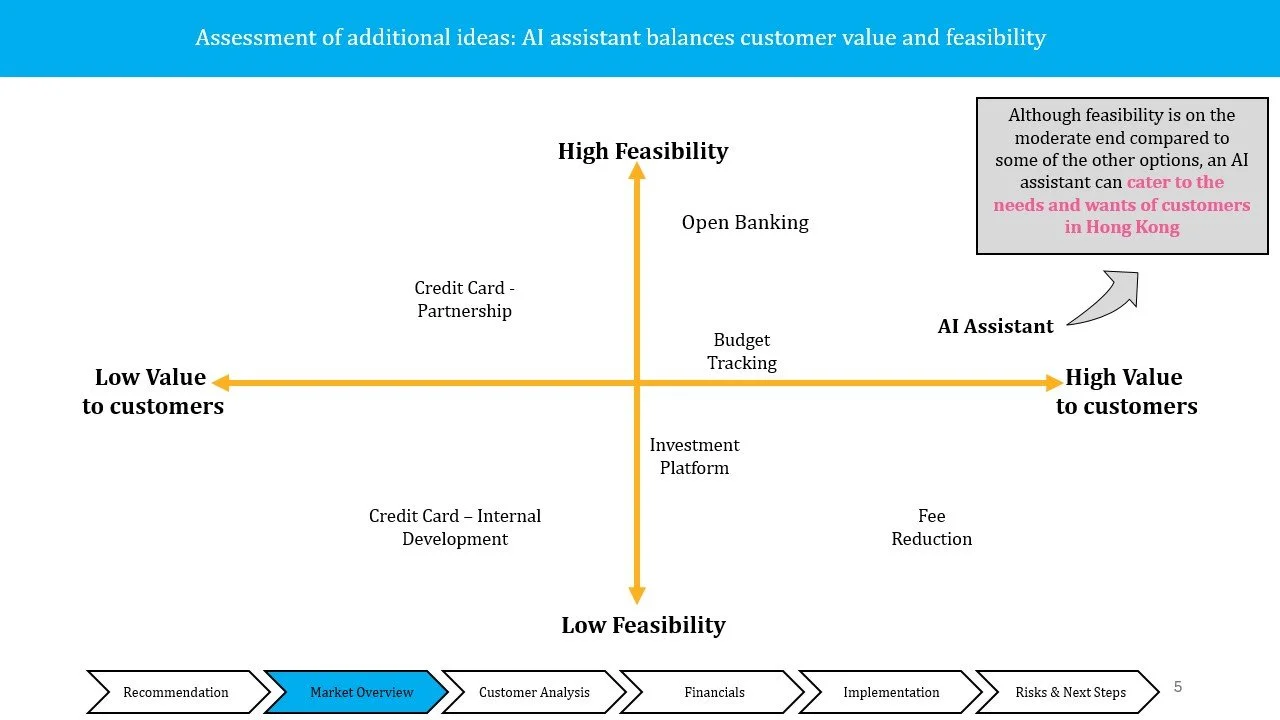

Helped prioritize strategic options (fee reduction, budget tracking, open banking, AI assistant) using a value versus feasibility framework.

Built components of the financial model estimating investment costs, revenue per customer, breakeven timing, and required customer acquisition.

Co-developed the implementation roadmap, including a 6 month launch plan and risk mitigation strategies across privacy, AI performance, and legal exposure.

Presented our final recommendation and supporting analysis to faculty and peers in a case competition setting.

Key Deliverables

1. Strategic Recommendation Deck (Slide Presentation)

An end to end presentation framing the problem, evaluating strategic options, and recommending WeAdvisor as the optimal path to democratize financial services while remaining financially feasible.

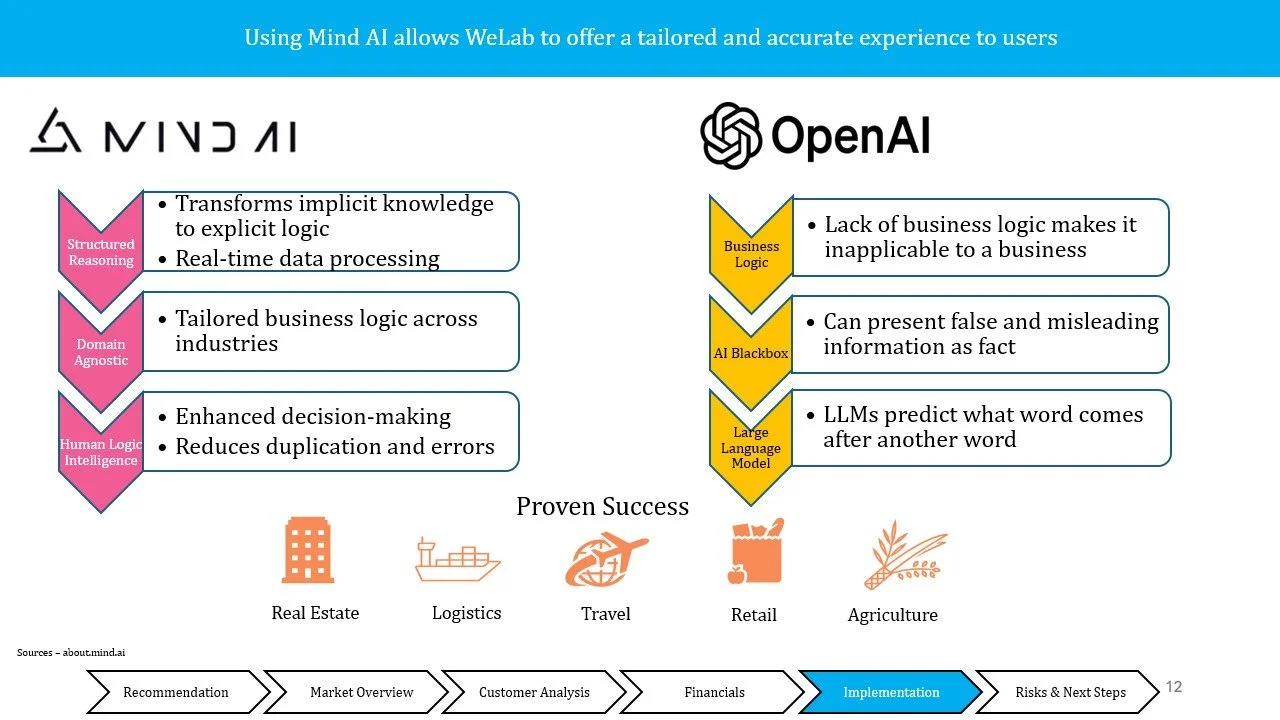

Clearly articulated the recommendation to launch WeAdvisor, an AI based financial personal assistant embedded in WeLab’s app.

Showed how WeAdvisor supports financial wellness, inclusion for lower income segments, and HKMA concerns around innovation and consumer protection.

2. Market and Customer Analysis Framework

A structured analysis of Hong Kong’s operating environment, competition, and target segments.

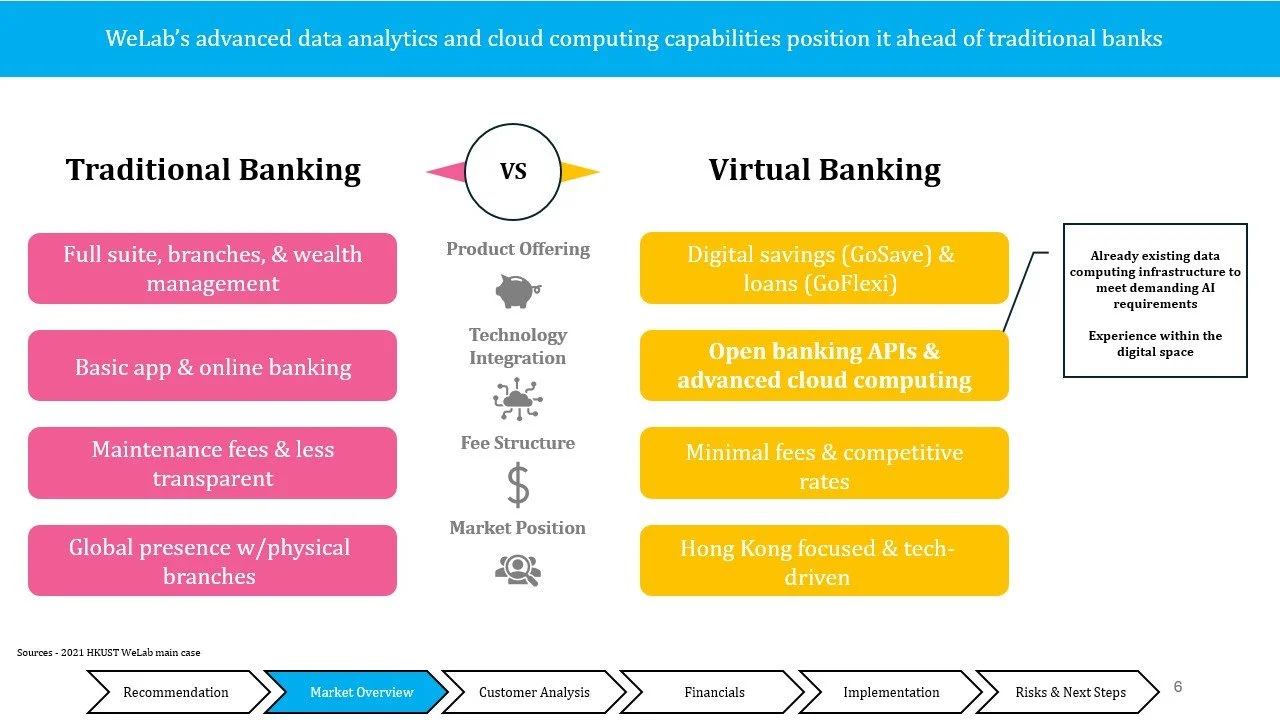

Assessed Hong Kong as a financial hub with strong digitization trends but low financial literacy and concentrated market share among four major banks.

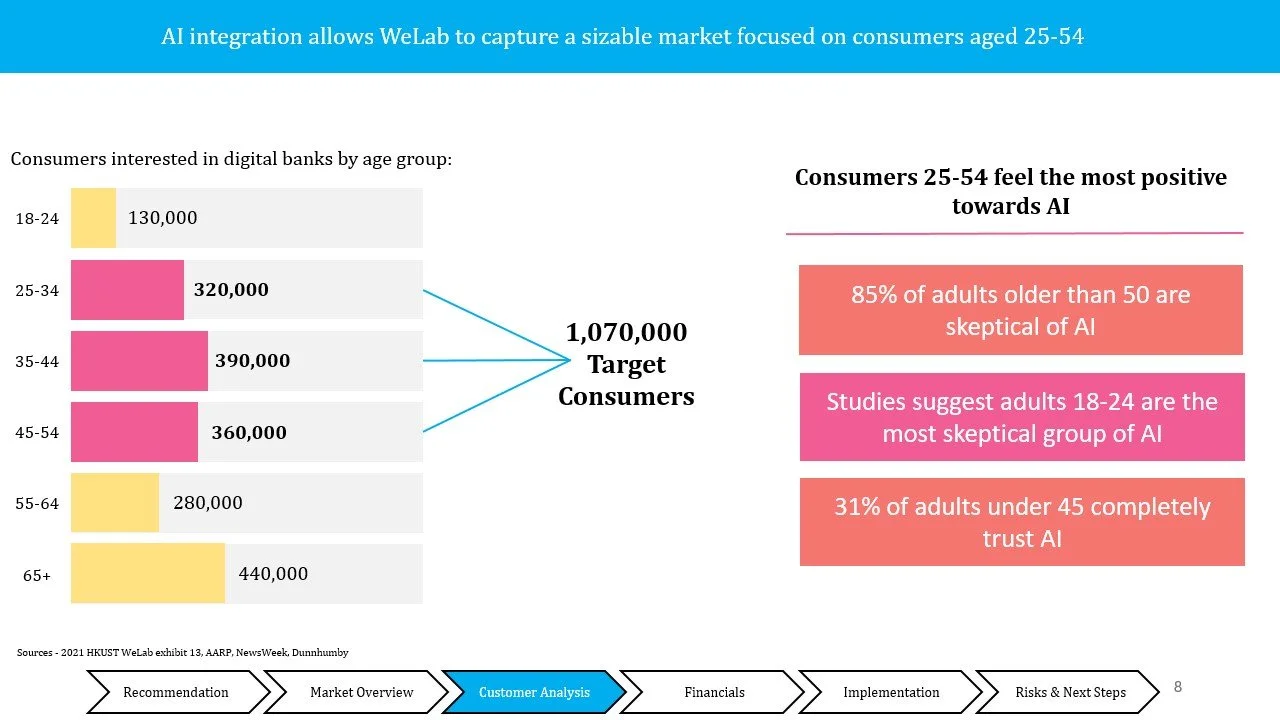

Sized the opportunity in virtual banking (HK$76B market, 1.9M potential customers) and defined a target segment of customers aged 25 to 54 who are most receptive to AI enabled banking.

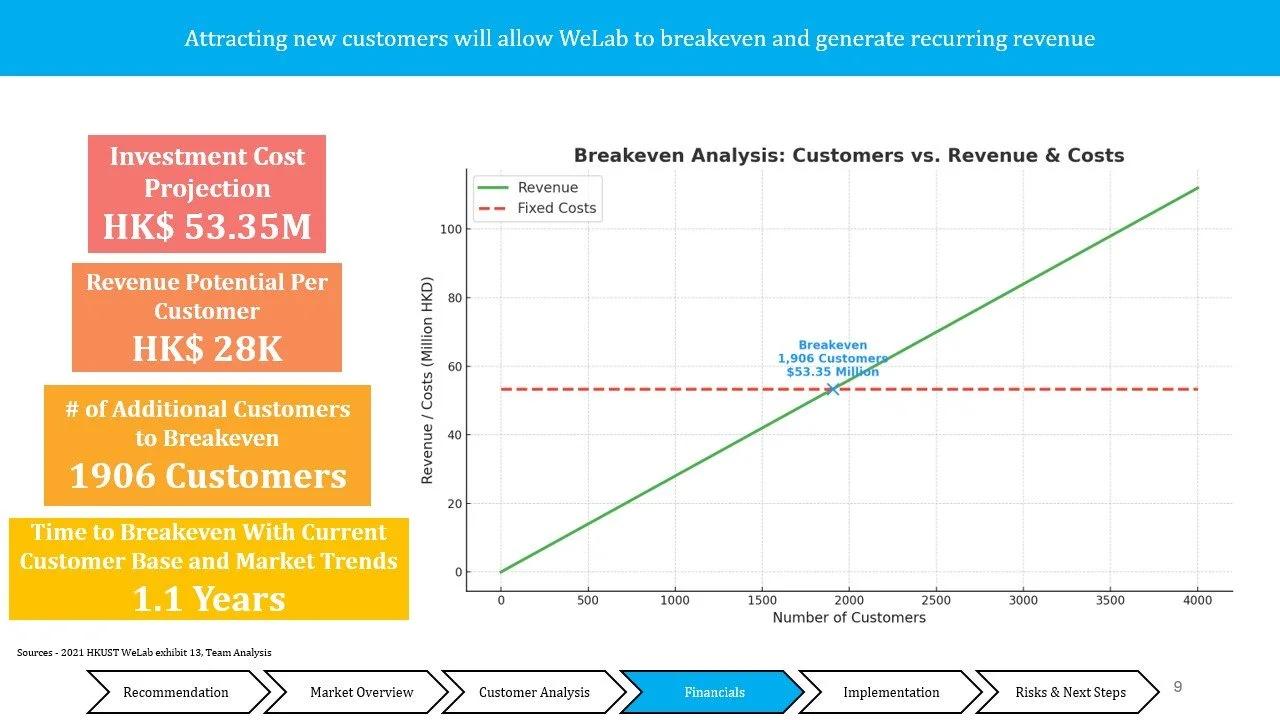

3. Financial Model and Breakeven Analysis

A quantitative model evaluating investment requirements, customer acquisition thresholds, and time to breakeven.

Estimated implementation costs of HK$34.55M to HK$53.35M across AI development, open banking APIs, cloud services, security, staffing, and marketing.

Modeled revenue potential of HK$28K per customer and calculated that WeLab would need roughly 1,906 new customers to breakeven in just over one year.

4. Implementation Roadmap and Risk Mitigation Plan

A 6 month execution plan plus a structured risk register.

Defined a phased rollout (strategy, design, development, testing, marketing and training, launch) with specific activities like regulatory alignment, data protection testing, and employee training.

Identified key risks (privacy, AI accuracy, legal exposure) and proposed mitigations such as restricted data access, AI trained only on bank data, and clear user terms and conditions.

Key Insights

AI can unlock financial inclusion at scale

An AI based assistant like WeAdvisor can provide personal financial guidance to segments that would not access a traditional advisor, especially lower income and younger customers with limited financial literacy.WeLab’s tech stack is a competitive advantage

Existing capabilities in open banking APIs, cloud infrastructure, and data analytics position WeLab ahead of traditional banks and enable cost effective AI integration relative to competitors.The economics of the AI assistant are attractive

With modest customer growth, WeAdvisor can breakeven in just over a year, showing that customer focused innovation and strong financial performance can work together.

Reflection

This project pushed me to think like a consultant at the intersection of strategy, technology, and financial inclusion. I had to balance customer needs, regulatory constraints, and financial viability to recommend a solution that was not just innovative, but also operationally realistic. Working on WeAdvisor strengthened my skills in structured problem solving, market and customer analysis, and financial modeling. It also deepened my interest in how AI can be used responsibly to democratize financial services for groups who have historically been underserved. This project is one I am proud to showcase because it reflects both my analytical strengths and my commitment to meaningful impact.